Crypto Lending with Proofs of Dynamic Assets

Unlike traditional financial lending, most on-chain loans require collateral from users. In the traditional financial system, credit is a broader form of lending that doesn't necessitate collateral and is based on credit information. However, in the DeFi world, due to the characteristics of trustlessness, permissionlessness, and the lack of KYC, it becomes challenging for DeFi developers to restrict borrowers based on off-chain behavior.

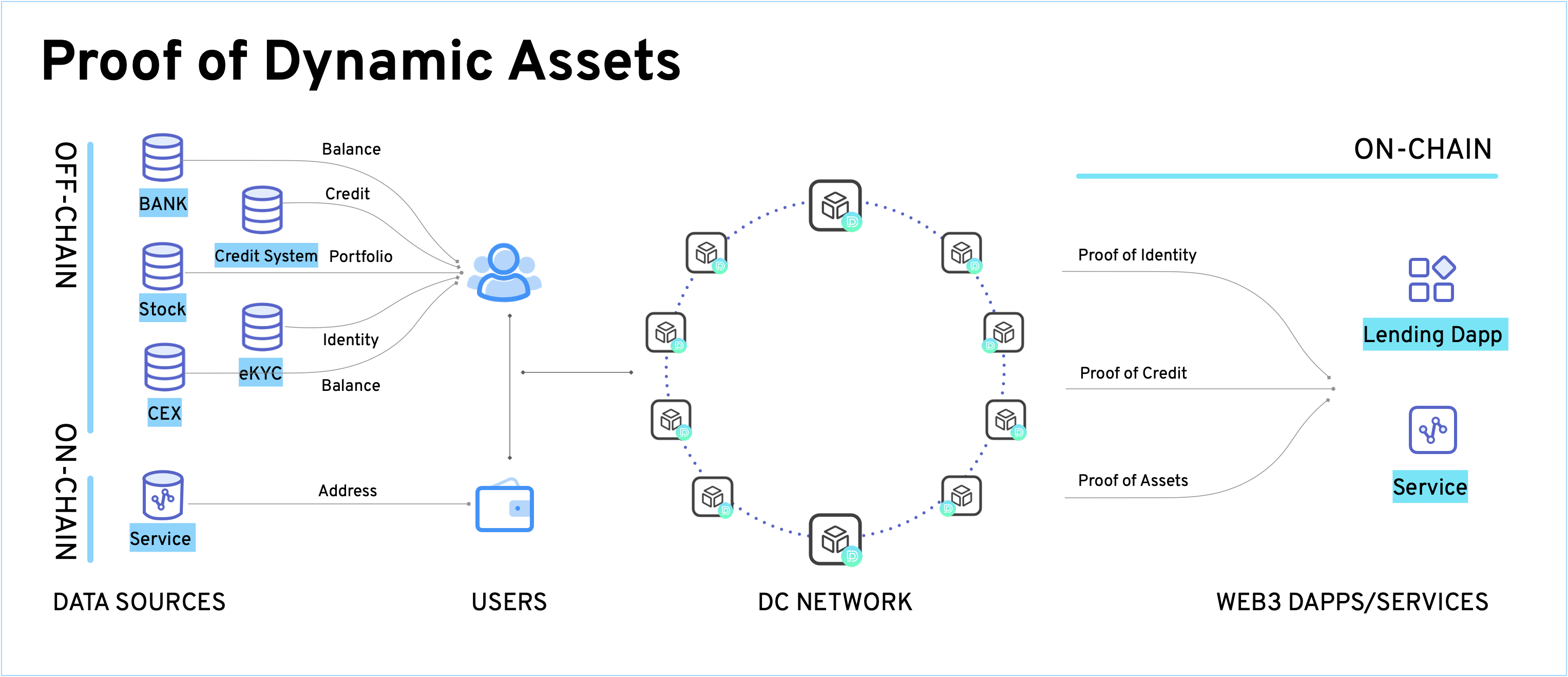

While many projects are exploring on-chain credit lending methods, it is undoubtedly a challenging task. The difficulty lies in how to lock off-chain assets and how to effectively recover them. Nevertheless, attempting to enhance the lending rate and asset utilization through a combination of dynamic asset proofs is worth considering.

Providers of funds can request borrowers to provide proof of identity, assets, credit, etc., off-chain, and then conduct risk assessments based on on-chain data to increase the original lending rate (e.g., from 70% to a higher ratio like 75-100%). Simultaneously, borrowers are required to provide dynamic asset certificates at an agreed frequency. When assets change within a specified range, repayment and liquidation will be triggered.

From increasing lending rates to exploring on-chain microcredit lending, the utilization of combined on-chain and off-chain data presents an opportunity to innovate DeFi applications once again.